Market Overview

The week started with a gradual decline due to tariff fears, which quickly escalated into a massive sell-off amid concerns about a trade war. Bitcoin (BTC) dropped from the weekend highs of $105,000 to $91,000 before gradually recovering throughout the week, stabilizing in the $95,000-$98,000 range. The total cryptocurrency market capitalization fell more than 12%, dropping from $3.708 trillion last week to $3.260 trillion this week.

Bitcoin (BTC) ended the week down 7.78%, while Ethereum (ETH) suffered a steeper decline, closing with a 17.88% drop compared to the previous week.

Daily liquidations on both sides spiked early in the week, with long positions bearing the brunt of the liquidations. Although official liquidation figures are around $2 billion, many estimate the actual total to be nearly five times higher, approximately $10 billion. Funding rates have unsurprisingly continued to decline despite already being in low ranges, signaling market fatigue and a wipeout of leverage in the system.

Key Events of the Week

The U.S. FDIC plans to revise crypto guidelines, aiming to allow banks to engage in certain crypto-related activities.

U.S. Senator Bill Hagerty introduces the GENIUS bill in the Senate, designed to establish regulatory clarity for U.S. stablecoins, licensing requirements for issuers, and more.

MicroStrategy rebrands to Strategy, adopting Bitcoin’s classic orange color and a new logo featuring Bitcoin’s stylized “B.”

Project News

Stablecoin issuer Tether announces plans to bring USDT to Bitcoin and the Lightning Network. This move comes shortly after their announcement of record-high $13 billion profits in 2024.

EVM L1 chain Berachain launches its long-awaited mainnet, just two days after releasing its whitepaper.

Chart of the Week: BTC

Bitcoin dominance surged to 64% before pulling back to 61%, highlighting the relative strength of BTC amid market downturns. This trend suggests that in times of uncertainty, capital tends to rotate back into Bitcoin as a safer asset compared to altcoins.

**This is an affiliate link. If you make a purchase through these links, I may receive a commission at no additional cost to you

If you like Tradingview charts and Crypto Highlights use the link below and get $15 to cover the cost of your new TradingView plan.

Airdrop of the Week: Berachain (BERA)

Berachain launched its highly anticipated BERA token airdrop, distributing 15.8% of the total token supply in its genesis drop. Of this, 6.9% was allocated to holders of Bong Bear NFTs and rebased NFTs. This airdrop rewards early supporters and aims to drive further engagement with the Berachain ecosystem.

Memecoin of the Week: PAIN

The PAIN memecoin presale raised approximately $40 million in SOL within just 48 hours. However, the team decided to refund 80% of the deposits, using the remaining 20% to provide liquidity and support project development. This move sparked mixed reactions within the community, with some appreciating the transparency while others remained skeptical about the project's long-term vision.

Educational Section: Understanding Liquidations in Crypto

Liquidations occur when a trader’s leveraged position is forcibly closed due to insufficient margin to cover losses. This week’s massive liquidations—estimated at up to $10 billion—were driven by extreme price swings in Bitcoin and Ethereum. High leverage can amplify gains, but it also significantly increases risk, as seen in this week’s sell-off. Understanding liquidation mechanics is crucial for traders, especially in volatile markets.

Conclusion

This past week was marked by heightened volatility in the crypto markets, driven by concerns over new tariffs imposed by the U.S. government. Bitcoin and Ethereum saw significant price drops, with a broader impact across the altcoin market. Liquidations reached extreme levels, wiping out leverage from the system and pushing Bitcoin dominance to new highs.

Despite market turbulence, regulatory progress continued with the FDIC’s proposed crypto guidelines and the introduction of the GENIUS bill, which could bring much-needed clarity to stablecoins in the U.S. Meanwhile, Tether expanded its presence by integrating USDT with Bitcoin and Lightning Network, reinforcing its dominance in the stablecoin sector.

While uncertainty remains, particularly regarding further tariff measures and their impact on global markets, crypto investors and traders will be closely watching upcoming regulatory moves and macroeconomic developments in the weeks ahead.

Other AAR HIGHLIGHTS newsletters:

If you liked this post and also want to be informed about other markets, you may want to subscribe.

Save your time with AAR Highlightss !!

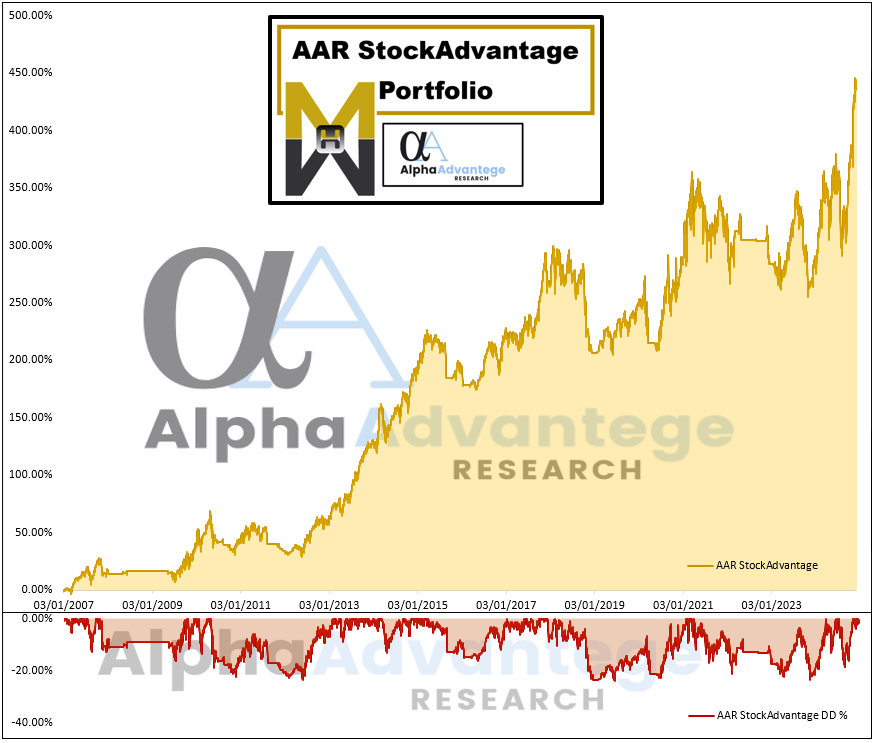

Weekly Market Highlights launches *AAR StockAdvantage Portfolio*

Weekly Market Highlights:

Until Next Week

That’s a wrap for this week’s Crypto Highlights! Stay informed and prepared as the crypto landscape continues to evolve. Don’t forget to subscribe to receive our weekly updates straight to your inbox. If you enjoyed this newsletter, feel free to share it with your friends and join the conversation in the comments! See you next week! 🚀