Market Overview

Economic Indicators and Market Response

The week began with market participants anticipating the release of key economic data, specifically the Consumer Price Index (CPI) and Producer Price Index (PPI). Despite both indicators showing higher-than-expected inflation, the market initially reacted with a sell-off but quickly recovered by the end of the week. The total cryptocurrency market capitalization increased by 1.62%, rising from $3.26 trillion to $3.313 trillion.

Performance of Leading Cryptocurrencies

Bitcoin (BTC) ended the week with a small gain of 0.16%, while Ethereum (ETH) saw a slight decline of 0.54% compared to the previous week. Market volatility remained relatively low, with daily liquidations staying under $300 million, and most days seeing liquidations below $250 million. Funding rates remained stable, indicating cautious leverage usage following the previous week's market corrections.

Bitcoin Dominance and Altcoin Surge

Bitcoin's dominance in the market slightly decreased, ending the week at 60.95%, down 1.69% from the prior week. This could signal a shift in investor interest toward altcoins. Some of the best-performing altcoins this week included AI-related tokens such as AI Rig Complex (ARC) and ai16z (AI16Z), both gaining over 50%. Additionally, BNB-based PancakeSwap (CAKE) surged nearly 100%. Other strong performers included Popcat (POPCAT), Magic Eden (ME), and Sonic (S).

Key Events of the Week

Strategy Expands Bitcoin Holdings

Michael Saylor's company, Strategy (formerly MicroStrategy), acquired an additional 7,633 BTC for $742 million, with an average purchase price of $97,255 per Bitcoin.

Ethereum ETF Developments

21Shares submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval to introduce staking to its Ethereum spot ETF. This move makes it the first ETF provider to propose such a feature.

Corporate Rebranding

Strategy officially rebranded, adopting Bitcoin's signature orange color and unveiling a new logo featuring Bitcoin’s stylized "B" symbol.

Project News

MegaETH’s NFT Initiative

MegaETH successfully minted its soulbound NFT collection, The Fluffle, raising 5,000 ETH for the protocol. The NFTs are non-transferable and entitle holders to a minimum of 5% of MegaETH’s token supply, subject to a six-month vesting period.

Unichain’s Mainnet Launch

Uniswap’s Layer 2 solution, Unichain, launched its public mainnet. It offers one-second block times and lower gas fees than Ethereum’s mainnet. Plans are in place to integrate Unichain with the Optimism Superchain later this year.

Chart of the Week: BTC

This week’s focus is on Bitcoin, which maintained stability despite inflation concerns. While its price movement was relatively muted, its slight gain of 0.16% suggests continued investor confidence amid macroeconomic uncertainties.

**This is an affiliate link. If you make a purchase through these links, I may receive a commission at no additional cost to you

If you like Tradingview charts and Crypto Highlights use the link below and get $15 to cover the cost of your new TradingView plan.

Airdrop of the Week: Story Protocol’s IP Token Airdrop

Story Protocol, a blockchain focused on tokenized intellectual property, opened claims for its IP token airdrop. The distribution includes 10% of the total token supply, and eligible wallets have 30 days to claim their tokens.

Memecoin of the Week: The Rise of Broccoli (BROCCOLI)

Following a tweet by Binance founder Changpeng Zhao (CZ) about his dog named Broccoli, a wave of memecoins named BROCCOLI emerged on both the Binance Smart Chain and Solana. The frenzy highlighted the speculative nature of memecoins and the power of social media influence in driving token valuations.

Educational Section: What is a Soulbound NFT?

A soulbound NFT (SBT) is a non-transferable token that represents ownership or membership in a project without the ability to be traded or sold. These NFTs are often used for identity verification, exclusive access, or governance rights in blockchain ecosystems. MegaETH’s The Fluffle collection is an example of an SBT that guarantees holders a share of future token supply.

Conclusion

This week demonstrated the crypto market’s resilience, as it shrugged off inflation data and continued its growth. Bitcoin dominance saw a decline, signaling increased interest in altcoins. Major corporate moves, such as Strategy’s Bitcoin acquisition and rebranding, reflected growing institutional adoption. Additionally, projects like MegaETH and Unichain showcased ongoing innovation in the sector.

Other AAR HIGHLIGHTS newsletters:

If you liked this post and also want to be informed about other markets, you may want to subscribe.

Save your time with AAR Highlightss !!

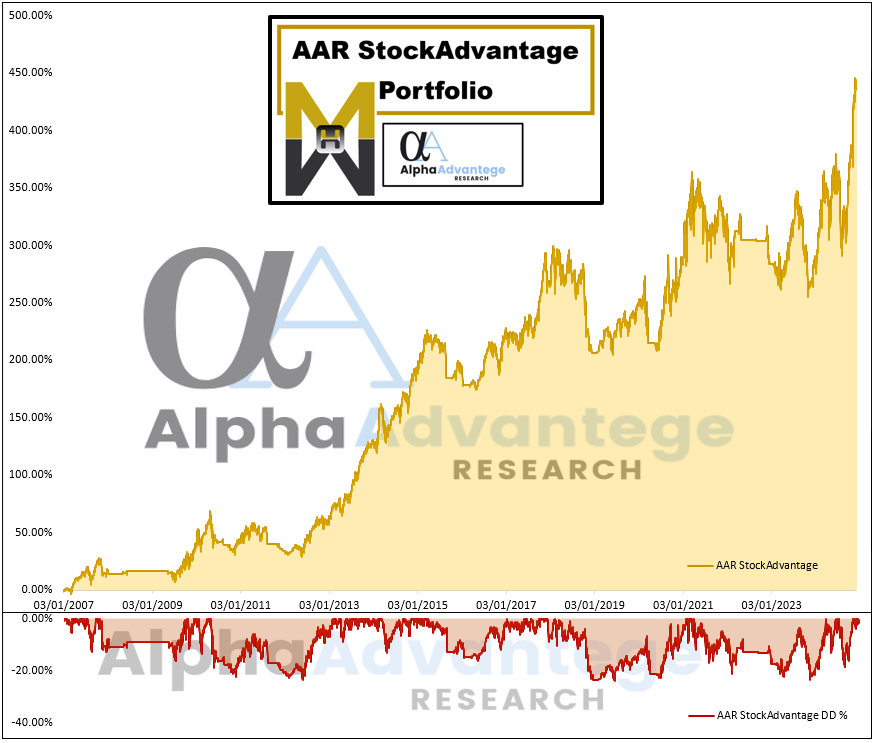

Weekly Market Highlights launches *AAR StockAdvantage Portfolio*

Weekly Market Highlights:

Until Next Week

That’s a wrap for this week’s Crypto Highlights! Stay informed and prepared as the crypto landscape continues to evolve. Don’t forget to subscribe to receive our weekly updates straight to your inbox. If you enjoyed this newsletter, feel free to share it with your friends and join the conversation in the comments! See you next week! 🚀