Crypto Highlights: Jan 27, 2025

Crypto on the Rise: Bitcoin Hits New Highs Amid Regulatory Shifts and Market Volatility

Market Overview

Bitcoin's New High Before a Retrace

Bitcoin (BTC) reached a new all-time high of $109,500 early in the week before retreating to midweek levels. This rally coincided with heightened anticipation around Trump's inauguration and speculation regarding pro-crypto policies. The overall crypto market cap increased by 2%, climbing to $3.732 trillion from $3.658 trillion the previous week.

Performance Highlights: BTC Rises, ETH Lags

Bitcoin (BTC): Gained 3.40% this week, driven by optimism surrounding potential regulatory changes.

Ethereum (ETH): Underperformed, posting a 0.88% loss compared to the prior week.

Liquidations and Funding Rates

Daily long-side liquidations spiked at the beginning of the week, with $800 million liquidated on Sunday and an additional $555 million on Monday. On the other hand, short liquidations remained relatively stable, averaging $100 million per day. Early-week funding rates surged due to speculation, but they normalized and closed in the single-digit range by week's end for both BTC and ETH.

Market Sentiment and Bitcoin Dominance

Investor optimism surrounding a pro-Bitcoin executive order led to a rise in Bitcoin dominance, which increased by 1.85% this week. Despite this, altcoins generally struggled, with only a handful of outperformers like Solana (SOL), Raydium (RAY), and DeFi tokens such as Chainlink (LINK) and Aave (AAVE).

Key Events of the Week

Trump Signs Executive Order Supporting Crypto

A historic executive order introduced initiatives such as a national digital asset stockpile, the end of Operation Chokepoint, and the promotion of dollar-backed stablecoins.MicroStrategy Buys More Bitcoin

MicroStrategy acquired 11,000 BTC for $1.1 billion, with an average price of $101,191 per BTC.New Memecoins Dominate the Market

The TRUMP memecoin launched on Solana, quickly reaching a peak valuation of $73 billion. This was followed by Melania Trump’s MEME coin, sparking a liquidity war among speculative investors.Ethereum Leadership Changes Announced

Vitalik Buterin addressed structural updates within the Ethereum Foundation to strengthen technical expertise and enhance communication within the ecosystem.DeFi Gets a Boost

Donald Trump’s World Liberty Finance token raised renewed interest, with the sale of 20% of its supply completed during the week.

Project News

Ethereum Foundation Leadership Updates

Vitalik Buterin unveiled plans for leadership restructuring within the Ethereum Foundation, aimed at fostering innovation and supporting decentralized application builders. This comes as Ethereum faces increasing criticism for its slower progress compared to rivals like Solana.

Lido Finance Expansion

Lido Finance’s founder, Konstantin Lomashuk, announced a new initiative, "Second Foundation," aimed at addressing disagreements within the Ethereum ecosystem.

Chart of the Week: BTC

Bitcoin hit a historic high early in the week before pulling back due to unmet market expectations during the inauguration. This chart highlights the week’s price fluctuations, capturing investor sentiment and market volatility.

**This is an affiliate link. If you make a purchase through these links, I may receive a commission at no additional cost to you

If you like Tradingview charts and Crypto Highlights use the link below and get $15 to cover the cost of your new TradingView plan.

Airdrop of the Week: Jupiter (JUP)

Jupiter, a Solana DEX aggregator, opened its JUP airdrop claims this week, distributing tokens to over 2 million eligible wallets. This airdrop rewards users for trading activity throughout the past year, with claims available for the next three months.

Memecoin of the Week: TRUMP Memecoin

The TRUMP coin launch, timed with Donald Trump’s inauguration, drove intense speculation and liquidity inflows. Peaking at a $73 billion valuation, this memecoin reflects the power of hype-driven markets and the ongoing interest in political-themed tokens.

Educational Section: What is Bitcoin Dominance?

Bitcoin dominance measures BTC's share of the total cryptocurrency market capitalization. This metric reflects investor preference for Bitcoin versus altcoins and often rises during periods of uncertainty or when BTC outperforms the market. In this week’s case, Bitcoin dominance increased due to optimism surrounding regulatory support for Bitcoin.

Conclusion

This week’s market movements were largely influenced by speculation around regulatory shifts and political events in the United States. Bitcoin solidified its dominance as investors embraced optimism over potential pro-crypto policies. However, altcoins struggled to keep up amidst the volatility. Ethereum's ecosystem saw renewed scrutiny, while memecoins and DeFi developments dominated market narratives.

Other AAR HIGHLIGHTS newsletters:

If you liked this post and also want to be informed about other markets, you may want to subscribe.

Save your time with AAR Highlightss !!

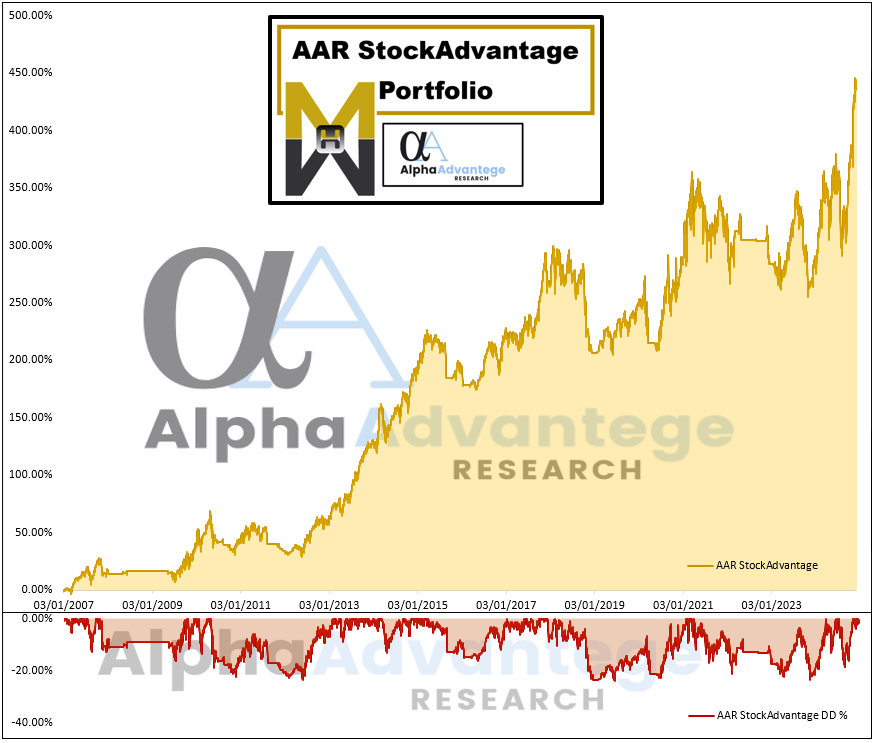

Weekly Market Highlights launches *AAR StockAdvantage Portfolio*

Weekly Market Highlights:

Until Next Week

Thanks for tuning in to this week’s Crypto Highlights! Don’t forget to subscribe to receive these insights directly in your inbox. Feel free to share your thoughts in the comments and spread the word. See you next week, and happy trading! 🚀